In the digital era of investing, online demat accounts have become indispensable tools for managing securities efficiently. However, as with any online platform, security concerns are paramount. Investors need assurance that their investments are safeguarded against potential threats and risks. In this article, we’ll explore the security measures in place to protect online demat account and the investments they hold, while also keeping an eye on the GAIL share price for potential investment insights.

Encryption and Secure Access:

One of the primary security features of online demat accounts is encryption. Leading brokerage firms employ advanced encryption protocols to secure user data and transactions. Encryption ensures that sensitive information such as account credentials, competitive Gail share price personal details, and transaction data are scrambled into unreadable code, making it virtually impossible for unauthorized parties to intercept or decipher.

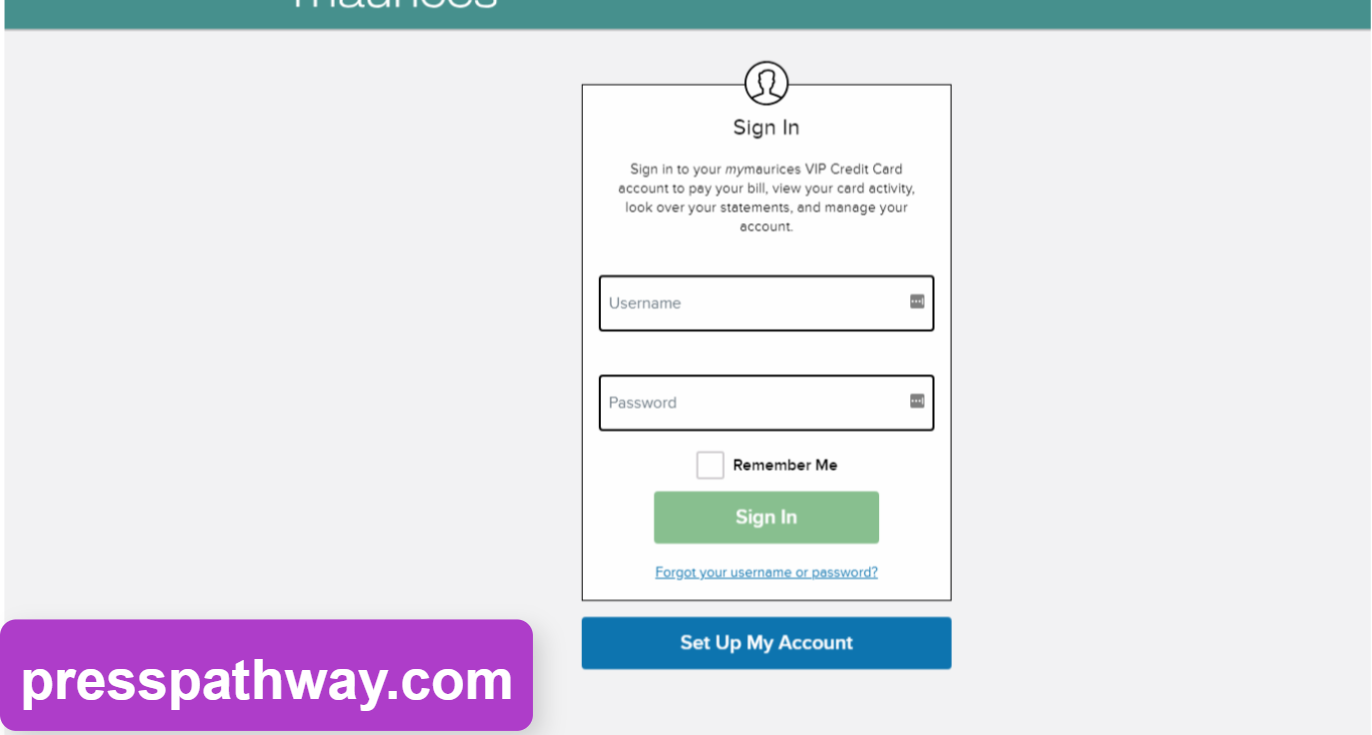

Moreover, secure access protocols are implemented to authenticate users and prevent unauthorized access to online demat accounts. Multi-factor authentication, such as one-time passwords (OTP), biometric verification, and security questions, adds an additional layer of protection, ensuring that only authorized users can access the account.

Firewalls and Intrusion Detection Systems:

Brokerage firms deploy robust firewalls and intrusion detection systems (IDS) to monitor and filter incoming and outgoing network traffic. Firewalls act as barriers between the online demat account system and external networks, blocking unauthorized access and potential threats. IDS constantly monitor network activity for suspicious behavior or anomalies, triggering alerts and responses to mitigate security breaches.

Regular Security Audits and Updates:

To stay ahead of evolving cyber threats, brokerage firms conduct regular security audits and assessments of their online demat account systems. These audits evaluate the effectiveness of existing security measures, identify vulnerabilities, Gail share price and implement necessary updates and patches to strengthen security defenses.

Additionally, software and system updates are deployed regularly to patch known vulnerabilities and address emerging threats. By staying vigilant and proactive in their security measures, brokerage firms ensure that online demat accounts remain resilient against potential cyber attacks and data breaches.

Insurance Coverage and Investor Protection:

In addition to technical security measures, investor protection schemes and insurance coverage provide an added layer of assurance for individuals holding online demat accounts. Regulatory bodies such as the Securities and Exchange Board of India (SEBI) mandate brokerage firms to adhere to investor protection guidelines and maintain adequate insurance coverage to safeguard investors’ interests.

For instance, the Securities Investors Protection Fund (SIPF) offers insurance coverage for investors in case of brokerage defaults or insolvency and Gail share price. This coverage provides financial compensation to investors for any losses incurred due to the failure of the brokerage firm, offering peace of mind and protection against unforeseen risks.

Monitoring GAIL Share Price for Investment Insights:

While security is paramount, investors must also stay informed about market trends and potential investment opportunities. Monitoring the GAIL share price, along with other stocks and indices, can provide valuable insights into market dynamics and investment trends. By analyzing the GAIL share price and conducting thorough research, investors can make informed investment decisions while ensuring the security of their online demat accounts.

In Conclusion:

Online demat accounts offer convenience and efficiency in managing securities, but security remains a top priority for investors. Through encryption, secure access protocols, firewalls, regular audits, and insurance coverage, brokerage firms ensure the protection of online demat accounts and the investments they hold. By staying informed and vigilant, investors can confidently navigate the digital landscape of investing while safeguarding their financial assets.